In yet another sign that Bidenomics is pushing Americans off a fiscal cliff, the rating firm Moody's downgraded the nation's credit worthiness to "Negative," a move that will slam Americans already suffering from hyperinflation, usurious interest rates, and a $33.7 trillion national debt that is sucking the wealth out of the U.S. economy.

"In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody's expects that the U.S.'s fiscal deficits will remain very large, significantly weakening debt affordability," the company said.

Economist EJ Antoni, with the Heritage Foundation, put the nation's financial predicament in harsher terms: "The idea that the economy is doing well is laughable. Inflation has become embedded and is running about twice the Federal Reserve's 2% target, as well as two and a half times the rate it was when President Joe Biden took office," he said in describing the impact of Bidenomics, the belief that Washington can continue to print and borrow money to fund its monstrous spending sprees. "Last year, inflation reached 40-year highs as prices throughout the economy set record after record," Antoni noted.

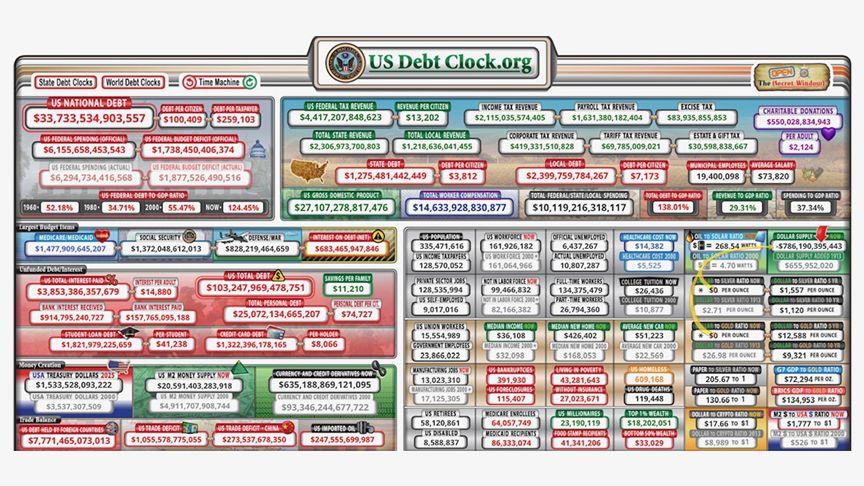

A glance at the nation's Debt Clock puts the problem in graphic perspective as the amount of debt heaped upon the U.S. taxpayer flashes by at blinding speed. According to the Department of the Treasury, the debt increases by about $36 billion per day, standing at $33,740,758,940,298 last week. According to the numbers, the inability of the country's elected leaders to come to grips with their spending problem increases the national debt by an astounding $421,384 per second. This means that every American taxpayer has been put in hock to the tune of $259,103 by their own government. To view the debt burden in real-time, go to www.usdebtclock.org.

"Moody's downgrade was entirely predictable considering the nation's fiscal condition and budgetary mismanagement," said Stephen Ellis, president of the watchdog group Taxpayers for Common Sense. "When you're paying nearly $660 billion a year to service $33.7 trillion in debt, lurching from budgetary crisis to budgetary crisis is policymaker malpractice."

According to Antoni, U.S. officials can address the debt problem either by skipping out on payments to China and other countries and entities, including the American Public, who loaned money, or by the Federal Reserve buying back the IOUs by printing trillions of dollars, the textbook cause of inflation that puts the debt on the American citizenry. Either solution, in the absence of massive spending cuts, would spell disaster for the U.S. economy.

Tragically, as interest rates skyrocket, so does the amount of debt the government is forced to cover, a situation that will dramatically devalue the currency. "Inflation has outpaced earnings growth so rapidly that the average worker has lost the equivalent of about 5% of his annual income from the dollar's reduced purchasing power," Antoni explained. Experts point to historical currency crashes as experienced in Germany and Argentina that were so drastic that workers demanded to be paid every day as money was worth more at the end of their shifts than the following morning.

|

| The numbers on the U.S. Debt Clock go up at lightning speed. File Photo |

"For the typical American family, today's higher prices and higher inflation are the equivalent of losing about $7,300 in annual pay," Antoni continued. "It's no wonder that roughly half of Americans think we're already in a recession when their personal finances have deteriorated so much so quickly. Families are drowning in over $1 trillion of credit card debt, and 60 percent of them are living paycheck to paycheck," he said.

And the news will only get worse. Under current projections, Moody's said interest payments alone on the U.S. debt will be equal to 26% of all federal revenue in 10 years, an increase from the current 9.7%. The situation has economists believing that the government will no longer be able to pay off any principal on the debt and only afford interest payments as Washington keeps abusing America's credit card at an epic pace.

The White House response to the nation's financial crisis has come under fire as President Biden continues to call for billions in war assistance for Ukraine and the Middle East, as well as fight to maintain record spending levels that were ratcheted up during the COVID shutdowns. Former House Speaker Kevin McCarthy (R-California) gave the administration a blank check through continuing resolutions that threw trillions more into the fire. His caving in to Bidenomics led to his ouster as fiscal Conservatives showed him the door in favor of Mike Johnson (R-Louisiana), who also capitulated to the Swamp by putting off any action on spending cuts for 75 days as the federal fiscal year drew to a close.

"Today's continuing resolution will allow us to continue working on appropriations bills and responsibly fund the government," explained Rep. Nick LaLota (R-New York), who voted on extending current spending. "We must stop governing by continuing resolution; the American people deserve better. Let's keep working, put up bills which can pass the House, and work with the Senate to reduce spending and keep our government open."

LaLota is a co-sponsor of the Prevent Government Shutdowns Act, which would require that if appropriations work is not done on time, all Members of Congress must stay in Washington, DC, and work until the spending bills are completed. "This will prevent a government-wide shutdown and continue critical services and operations for Americans," the Congressman said. Nevertheless, after passing the continuing resolution and failing to advance bills for billions in funding for Ukraine and Israel, Congress adjourned for a two-week hiatus.